Financial institutions face their fair share of challenges when it comes to growing and retaining a happy, loyal customer base. People have any number of choices of where to bank, and to consumers it can feel like there’s not much difference between banks and other companies offering financial services. Plus, financial institutions all comply with the same government regulations, which can make it seem like most banking services are all the same.

When it comes down to it, this is what will really set your bank apart from the next: the seamlessness with which customers can interact with your services and the quality of service offered — i.e., the customer experience.

Why customer experience is so important for banking

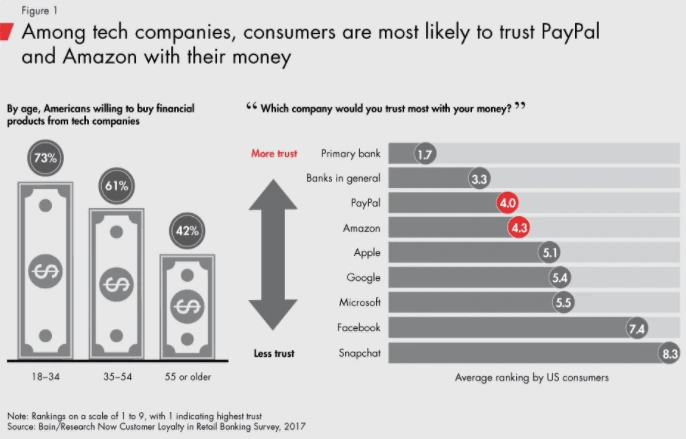

Competition in the industry is fierce. It’s estimated that tech companies will swallow up 40% of the $1.35 trillion in financial services revenue from banks. Tech giants like Google, Amazon and Apple already have a huge base of loyal customers and they’re transitioning their success to financial services. A survey from Bain shows that consumers from the US and UK trust PayPal and Amazon nearly as much as they trust banks.

(Source: Bain & Company)

These companies are highly skilled at providing a level of fast, easy service that’s hard for regular banks to match. Tech companies have been honing their customer experience skills for years, and now they can apply it to financial services. Banks are being held to those standards and it’s getting tougher and tougher to keep up. You’re not only competing with the myriad of other banks — now you’re competing with tech giants too.

That’s why focusing on CX and providing a superior banking experience is so crucial for financial institutions, big or small. CX is often one of the few ways you can differentiate yourself from competitors. Even if your product can’t quite compete with other companies, offering a seamless and supportive experience can keep customers happy and coming back.

8 ways to improve CX in banking

Improving the customer experience will take persistence and a multipronged approach. Here are eight things you can focus on to improve customer experience in banking.

1. Look at it from the customer’s point of view

This probably seems obvious, but it can’t be overstated. Often what companies think they need to do to improve customer experience is quite different from what their own customers would actually like to see improved.

Instead of looking internally to better your CX, dig in to your customers’ opinions. This can take a few different forms, the best one being talking directly to customers.

- Consider setting up a customer advisory board. A CAB will give you consistent access to a set of voices that can provide the external insight you need.

- Regularly employ customer surveys after various transactions to get a sense of how seamless (or not) each transaction or service is.

- Map your customer journeys. Financial institutions will have a lot of different customer journeys to account for, but give each one the time it deserves. Walking the path that your customers take is the only way to really understand their pain points.

2. Get the C-suite to commit

In order to find success with your CX initiatives, you’ll need full buy-in from the higher-ups. Improving customer experience at your financial institution will likely lead to big changes in your current system, products and processes. Without support from senior leaders, it will be hard to see true change in your organization.

Make sure leadership is involved in CX improvement plans from the very beginning. When your executives participate, lead by example and show that it’s a priority, the rest of your organization will start to embrace the new changes.

3. Establish a dedicated CX team

Rather than having one simple plan to improve CX, you’ll need a variety of strategies that involve people from all departments of your bank. Pull together a team of stakeholders from across your business to help manage customer experience improvement.

You’ll need their insight into their specialties, and they’ll operate as the point person for CX efforts in their department. A diverse team can bridge the gap between the different services your bank offers as well as silos that can arise from having multiple locations, possibly spread across the country. Depending on the scale of your customer experience initiatives, it may even make sense for your bank to bring in a dedicated CX role to head up this team.

4. Offer unique services

While this is arguably one of the more difficult aspects of providing an exceptional customer experience, having a product or service that truly sets you apart from competitors can be invaluable.

Look to leaders in the industry for ideas on innovative digital services. Bank of America attracts customers with access to its free virtual financial assistant, Erica, that helps people with everything from checking credit scores to bill payment reminders. Spanish bank BBVA’s app offers Bconomy, which helps customers track their finances and work toward a savings goal.

All banks have apps, but going above and beyond the basics to identify tools that really help people will make for a meaningful customer experience. Evaluate how your bank can address customers’ financial health holistically, rather than focusing on a single service at a time.

5. Balance digital and human service

While it is true that consumers now expect effortless digital services from their bank, you can’t rule out the importance of having humans readily available for customer support. You’ll need to find the right balance of the two.

Balance your digital initiatives with a strong commitment to personal customer service. People love to do things online, but if they hit a snag or have a complex problem and there’s no phone number where they can easily reach someone for help, it makes your organization seem untrustworthy. Being able to quickly get through to a friendly, helpful representative will be a huge boost to your customers’ banking experience.

6. Scale your efforts

One of the hardest parts of customer experience is getting your entire organization — every location — to deliver on new CX efforts in a consistent, sustainable way. Being able to successfully scale your customer experience is key for the health of your bank.

With your dedicated CX team, you’ll want to create a plan of attack for business-wide adoption. Look at which initiatives are doing well in which departments and analyze how you can apply or translate those successes to other departments. Learning from specific failures and successes, you can begin to apply changes to larger parts of your organization until the bank as a whole is compliant with updated customer experience standards.

7. Keep your brand consistent

Brand consistency bolsters CX efforts by guaranteeing your customers are always interacting with a familiar company. When your brand always looks and sounds the same — e.g., your design, voice, tone and messaging is consistent — your customers know what to expect. They’ll be comfortable with your brand, and you’ll see brand loyalty from them in return.

Brand templating will help keep your brand consistent across departments and locations. Making customizable design templates available to your company will ensure that each branch stays on-brand and uses approved logos, colors, assets, etc. It also cuts down on off-brand and one-off creations that don’t reflect your organization’s brand style. Templates can range from flyers and brochures to social media posts, emails, presentations and more.

Presenting a unified front to your customers will both bolster CX efforts and help strengthen your brand.

8. Follow up

Customer experience is something you’ll have to continually revisit. What customers want and expect from a financial institution will evolve over time. And once you improve one thing, something else will pop up that could be better too — that’s just the nature of business. Plus, CX improvement often isn’t a straightforward, linear process. There’s going to be trial and error, and you’ll need to keep at it to find the right solutions for your bank.

Just like you set goals and OKRs for each quarter and year, you’ll want to do the same for customer experience. Make CX a focus in all of your strategy plans and hold people accountable in the same way you do for financial goals.

Dedication to leveling-up your customer experience will pay off in happy customers who are more likely to stick with your bank and recommend your services to friends. For more tips on improving CX and creating personalized experiences for your customers, check out our free guide How to avoid CX failure and empower your team to become your greatest CX asset.

The long tentacles of coronavirus have touched every aspect of our lives, and especially so for the mortgage industry. It’s not clear where the housing market is going to end up, but right now things are busy.

For consumers, there’s the allure of rock-bottom interest rates, while many people are also facing new, stricter standards for loans. And others are apprehensive about making any moves, literally and figuratively, when the economy is so volatile.

It’s predicted that mortgage lending will reach a 14-year high in 2020. With the surge in refinances, you may find yourself busier than ever. So this is good news… right? We’ll take our silver linings where we can get them.

Amidst the hustle and all the uncertainty, you may be looking for ways to reassure clients, build business, set yourself apart, and work efficiently so you can handle what lies ahead. We’ve thrown together our best tips and ideas for mortgage marketing to help you navigate that new normal.

Behind every loan officer, there is a strategy

Keep these four things in mind as you polish your mortgage marketing strategies.

Be human

Buying a house is enough to make anyone anxious… combined with the stress and unknowns of the current world climate, you’ve got a recipe for, well… even more stress. Doing your best to be as real as possible (aka “human”) can make your clients feel a little better about navigating the mortgage market during what feels like the apocalypse.

Research shows that over 75% of people expect a business to understand their needs and situation. Show potential clients that you can empathize with their worries by simplifying the mortgage process as much as possible. Review your marketing materials and see where you can decode or simplify the language.

But what does being human mean in the context of marketing? You may be wondering, “Aren’t I already human?” Good question. Being human simply means, speaking plainly and communicating with clients in the same way they communicate with you. It means not sounding like a marketer or loan officer. For example, instead of focusing solely on numbers and low interest rates, translate that to what it means for the client. Maybe “Save X% on your monthly payment,” becomes, “Now you can put $X more in your savings account or toward a new car.”

Ideally, all of your communication —everything from the way your company messages itself to how loan officers speak with clients — should be presented in a way that’s accessible, compassionate and personable.

Leverage your visual content experience

Make sure you’re paying attention to your appearance, so to speak. Unfortunately, people do notice the inconsistencies that pop up across your website, social media and printed materials. A study from Salesforce noted that 75% of consumers have come to expect consistency from businesses and brands “with 73% likely to switch brands if they don’t get it. Customer loyalty — and attrition — is determined by every experience. Predictive, anticipatory service is increasingly the norm.”

With large brokerages like Rocket Mortgage becoming more familiar to consumers (and making the market all the more competitive), smaller operations need to throw some resources into branding and customer experience. Maintaining a consistent brand, in both design and voice, can reassure clients of your quality and trustworthiness, which helps your organization stand out in a crowd.

Evaluate where brand inconsistencies are stemming from. Do you need to update your brand style guide? Are brand assets easily available to everyone? Are brokers creating off-brand content? Consider solutions like design templates for brokers that have branded elements already in place. Empowering everyone at your organization to make their own, on-brand content can cut down on the noise and inconsistencies you’re seeing across marketing channels.

Get cozy with digital marketing

Putting together a solid digital marketing plan is key for generating new leads. And social media will offer the most bang for your buck.

We recommend building a solid content plan for LinkedIn — this is where you’ll find real estate agents, brokerages and builders that you can connect with to grow your business. Facebook can also be a great platform for reaching homebuyers — but LinkedIn is the best place to expand your circle and show other people in the industry what your business is about.

Social media is designed for building community, and it’s an ideal place to connect with new people. Taking small steps like reposting listings from agents you’d like in your network and commenting on content that’s interesting to you can help your business grow a healthy following.

Have you helped anyone land their dream home lately? Posting about client success stories makes for feel-good content that people like to see in their feed. Keep the content you post diverse and engaging with a smattering of home-buying tips, mortgage knowledge, property listings, industry news, and anything else that piques your interest.

Automate where you can

Staying on top of digital marketing is no small task — especially if you haven’t got a team to help. Automation could be your best friend, and luckily, there’s not much you can’t automate these days.

- Email — Emails can be easily automated, and it would be a great time to do, say, an email drip campaign about refinancing. Over the course of a few emails you could talk about the benefits of refinancing right now and what the process entails from start to finish. Look into a tool like Mailchimp, which is designed to help smaller businesses automate email campaigns and reach customers without doing much heavy lifting.

- Social media — You can also set up your social media posts to be automated by a tool like Buffer. Automation platforms like this will post content for you based on a schedule you set, and they even have tools that analyze how your content is performing. Good analytics can be helpful if you feel like you’re not getting enough engagement or want to tweak your social strategy.

- Content creation — Certain design platforms (like Lucidpress ?) also offer data automation, which can be invaluable for customized marketing campaigns. Data automation lets you connect to spreadsheets or even your MLS — then you can quickly upload a bunch of information to marketing materials as needed. This is an easy way to create custom collateral for your clients that won’t cost you any extra time or energy.

Take a look at your current marketing campaigns and see what you can automate. Automation will free up your time so you can focus on more pressing things or even brainstorming your next big marketing venture.

However you decide to implement mortgage marketing ideas for the new normal, be sure that your strategies support any long-term goals you might have for your company. Conduct an audit of your existing business continuity plan to see where any of these ideas fit in. Alternatively, it couldn’t hurt to create a new business continuity plan if yours might be a bit outdated. And, if you want to do a deeper dive on how you can strengthen your brand, check out our free ebook on brand consistency and how it impacts your ROI.

Content marketing within the financial services industry has been lagging for years now. Because of this, financial service firms need to evolve in the ways they target customers and clients. This is where content marketing comes in — it can provide that edge a financial services company needs to beat out their competitors.

To help you be successful in your financial services marketing, we’ve put together six ways you can market your services and business with content strategy.

1. Embrace social media

Social media has become a powerhouse for financial services marketing and nearly all other industries. More than 90% of Gen Zers, over 80% of millennials and 70% of Gen Xers believe brands need a Facebook page. Facebook, LinkedIn, Instagram … they each provide the chance for companies to target multiple demographics, and it’s critical for your team to know where your customers like to hang out on social media.

How to start

- Begin by learning what content plays well on which platform.

- Identify your target audience.

- Craft a specific message for each channel following best practices for that platform.

- Strive for a mix of content that includes educational material along with news or promotional content.

- Post on a clearly defined schedule.

- Remember to be consistent with your branding and messaging throughout each channel.

As you start to create content, aim for images and captions that humanize your business — these will pique your audience’s interest. Don’t forget, too, that social media can become a great place for getting feedback from clients and customers. When Barclaycard developed its Ring MasterCard, the company reached out to existing customers on social media and asked for ideas. The Ring MasterCard has been recognized as the first social credit card to be designed and built through the power of community crowdsourcing.

2. Create educational content

With so much information at our fingertips, we’re always learning. Content marketing financial services can be a great way to not just generate traffic to your website but also to create potential conversations and awareness. By providing educational content through a blog, you can make your brand name trustworthy and become a go-to for people who are looking for specific content on financial services.

How to start

- Consider starting a blog or having an “education” tab on your website that houses helpful articles.

- Do a little research to discover what kinds of topics people are interested in learning more about, even if it’s just simple jargon. Remember that your customers aren’t finance experts like yourself. Simple, straightforward content can be hugely beneficial to building trust with your audiences.

- Use a content calendar to help you produce timely, relevant content.

Creating educational content can be vastly beneficial for financial services marketing. Take it from Liberty Mutual, who created an Alexa skill for customers to “receive actionable advice on common home and auto worries.” American Express has also used educational content to its advantage with a blog dedicated to helping small business owners get more clients and engage with their customers more.

3. Incorporate content personalization

Following the themes from above, knowing your audience is a huge aspect of financial services marketing. People love personalization — it’s why the customer journey has become the main focus for just about every marketing campaign. In 2019 alone, 35% of marketers in financial services were focusing on personalization, and that wasn’t just for kicks. According to data from Boston Consulting Group, personalization can offer a revenue boost of 10 to 30%.

Ensuring your company knows who the customer is and what their needs are not only makes them feel valued but also gives you a way to offer more applicable services.

How to start

- To personalize your content in the financial services sector, you first need to understand your customer base. Create persona profiles for different types of customers and work to build accurate customer records.

- Invest in tools that give you a look into your customers’ behavior in relation to your platform. And then use this data to make not only your products more relevant but also your content more relevant.

- Get feedback. Conduct surveys to understand how your banking customer experience is fairing. Direct feedback from customers can help you see where you’re falling short on the customer journey and what needs to be fixed, enhanced or made more personal.

Matthews Asia, a financial services firm specializing in Asian investments, uses Episerver integrated with data sources like CRM to drive personalization within its organization. Technology like this can help financial orgs with personalization by doing things like customizing the user experience to match whatever search terms were used or whatever content was viewed. For example, if someone searches for “mortgage rates” on your website, you can then use that info to see that mortgage content shows up for them — similar to how cookies and targeted ads work, but more specific to your site.

At the end of the day, the best way to achieve content personalization is to simply put the customer first. You’ll learn their wants and needs, which will in turn influence the way you advertise and market to your audience.

4. Adopt video marketing

Would it surprise you to know that YouTube has become the second largest search engine? Around 86% of YouTube viewers say they use the platform regularly to learn something new, which is why financial services marketers have started to invest heavily in video marketing. In fact, nearly 97% of marketers say video has helped boost user understanding of their services, and 76% say it’s increased sales.

We are naturally more attracted to video content over large blocks of text. By incorporating video into your marketing campaigns, you can explain complex financial products simply while also building a more transparent relationship with customers.

Take Bank of America, for example, who’s created video testimonials and interviews for its audience. Its video series show real people with real jobs being asked how they handle financial responsibility, so viewers can find out how their peers navigate the world of work in their own words. Bank of America uses a video library to house all of the videos in the series in one location, making it easy for viewers to navigate while also increasing the amount of time spent on the website.

A good starting point is to begin with the following video topics: guarantees, competitor differentiators, testimonials, firm history, video guides and how-to videos.

Each one of the above video ideas has garnered success among other institutions. For instance, WealthSimple has used extraordinary brand storytelling to accumulate over 1 million views on average. The company highlights its brand messaging “Investing for Humans” by bringing real faces to the stories in the videos.

5. Employ digital storytelling

Storytelling became one of the most effective marketing mediums long ago, and it still holds that title today. Whether in video, ads, on social media or cross-channel platforms, digital storytelling allows your marketing to extend into the real world.

How to start

- Figure out what story you want to tell, and make sure it’s consistent across all departments.

- Don’t focus on just one marketing strategy or try to incorporate everything in all at once.

- Identify how to tell a story that captures interest and evokes emotion.

You want to excite and move your viewer through relatable and shareable content. This content can either educate, entertain or simply help the audience in some way.

Let’s look at Allstate’s “Worth Telling.” In this marketing campaign, Allstate focuses on telling the story of a handful of customers who are making a difference. Through this campaign, Allstate is not only promoting what its customers are doing but also building trust by sharing real people with real stories.

6. Ensure sales and marketing alignment

Breaking down walls between departments in your financial services is crucial for content marketing to be effective. Today, just about everyone is a content creator within your firm. It’s no longer solely up to the marketing team to share content or post on social media. As such, you need to ensure that your sales and marketing teams are aligned on all aspects surrounding financial services content marketing.

A great way to achieve alignment between departments is to use templatized content. Templates can give you the control you need to ensure brand consistency and compliance while also empowering anyone to customize and distribute content as needed. A content marketing platform with a library of pre-approved templates is a great way to start.

As you start your journey on this new content marketing road, you’ll come in contact with lots of information around the content experience and customer journey. To give you a leg up, we’ve created an ebook on how you can deliver the extra 1% to your customers by providing a memorable content experience. Download it for free below.